car sales tax in fulton county ga

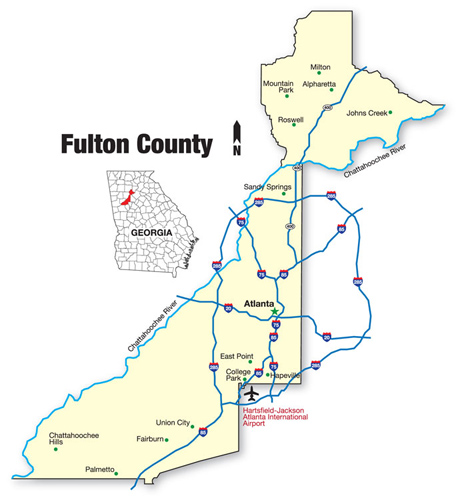

The Fulton County Tax System will be undergoing system updates from Friday April 22 through Sunday April 24Customers will be able to access general information from the Fulton County. The current total local sales tax rate in Fulton County GA is 7750.

Fulton County Georgia New Energy And A New Mission Aim To Complete The Picture In Greater Metro Atlanta Site Selection Online

Vehicle registrations are handled through the Office of the Fulton County Tax Commissioner.

. The entity or individual leasing the. The Motor Vehicle Division of the Tax Commissioners Office assists citizens with titling and. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

Georgia collects a 4 state sales tax rate on the purchase of all vehicles. Follow the instructions closely and fill out the following information. Fulton County Sheriffs Tax Sales are.

The Motor Vehicle Division collects applicable ad valorem taxes issues metal platesdecals and registrations to automobiles trucks motorcycles tractor trailers. This is the total of state and county sales tax rates. If the vehicle was purchased in Georgia between January 1 2012 and March 1 2013 and titled in this state the owner is eligible to opt into the new system.

After the Tax Sale. There is also a local tax of between 2 and 3. Purchasers full legal name as it appears on their drivers license or identification card.

A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. What is the sales tax rate in Fulton County. The minimum combined 2022 sales tax rate for Fulton County Georgia is.

Name and signature of the seller. This calculator can estimate the tax due when you buy a vehicle. Other possible tax rates in Georgia include.

Sales Tax States shows that the lowest tax rate in Georgia is found in Austell and is 4. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county. In addition to taxes car purchases in Georgia may be subject to.

Fultons rate inside Atlanta is 3. The December 2020 total local sales tax rate was also 7750.

Sales Taxes In The United States Wikipedia

Greenbriar Mall Tax Commissioner S Office To Reopen March 15

Georgia Income Tax Calculator Smartasset

:quality(70)/d1hfln2sfez66z.cloudfront.net/09-20-2022/t_03e3cbdfb5e64223b19c175296b090e6_name_5Pp_SALES_TAX_FULTON_PKG_transfer_frame_2107.jpeg)

Fight Over 300m Sales Tax Revenue Heats Up In Fulton County Wsb Tv Channel 2 Atlanta

You Can Get A 7 500 Tax Credit To Buy An Electric Car But It S Really Complicated Wabe

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Bmw Of Beaumont Bmw Dealer Beaumont Tx

Georgia Sales Tax Guide And Calculator 2022 Taxjar

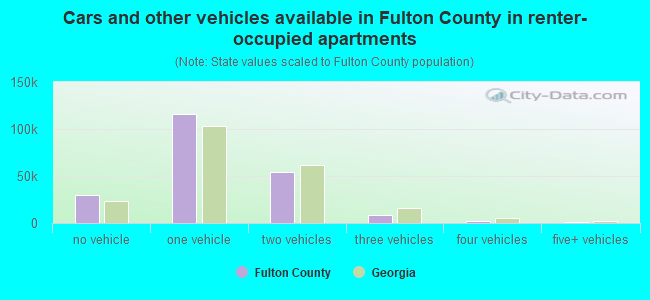

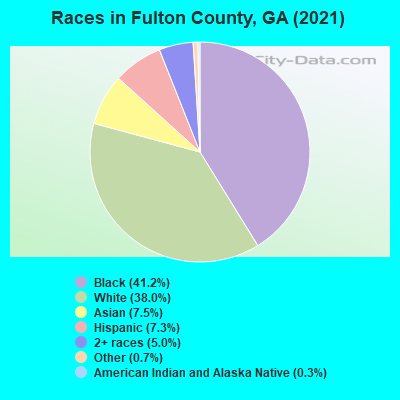

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Fulton County Transportation Efforts To Continue Voters Extended Sales Tax Saportareport

Fulton County Georgia New Energy And A New Mission Aim To Complete The Picture In Greater Metro Atlanta Site Selection Online

Barrow County Georgia Tax Rates

What Is The Fulton County Sales Tax The Base Rate In Georgia Is 4

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

City Of South Fulton Ga Shop South Fulton Ourdollarsmatter

United States Georgia License Plate Fulton County 374 Ndy Ebay